Written by Yanis Kharchafi

Written by Yanis KharchafiThe 10 tax deductions to claim in 2024 in Geneva

Ahhh… Geneva! Its Water Fountain, afterworks, banks and watchmakers … so many delights! And the ones living in this beautiful city know that it has so much more to offer, beyond good cheese and a waterfront favorable to a well-deserved lunch break. What then? We’re talking about the sweet tax headache that’s just around the corner. Remember? The 2024 tax return.

If the mere prospect of such a mission brings you goosebumps and after careful and repeated considerations, you have concluded this fight will not be yours, that’s fine too: you are not alone. We redirect you straight to the page that will introduce you to our tax return service in the canton of Geneva so that you can better breathe and enjoy your time off.

For all the Rubik’s cube enthusiasts, determined to cross swords with GeTax 2024, this article will help you to identify and understand the main ICC tax deductions to claim according to your situation, and thus limit your tax burden.

But first, a quick reminder. If you have not yet read the previous chapters of our guide on Geneva taxes in 2024, here are some useful links that will shed some light on the calculation of cantonal and communal taxes, as well as wealth tax.

You can also find out about the 13 main tax deductions in the canton of Vaud and in the canton of Valais.

As Michael Buffer would say: Get ready to rumble!

The line-up:

Deduction #1: Business expenses: what are the options?

Meals and Transportation Expenses

Regardless of your situation, you can claim deductions for transportation and meals. We have decided to combine them because you will have to make a single choice that will impact both deductions: should you rather go for actual or flat rate?

Actual business expenses

The tax authorities allow you to deduct, under certain conditions and within certain well-defined limits in Geneva, the expenses generated by the simple fact that you have a job and that you must, in most cases, get to the office on a regular basis. This includes:

- Business expenses: transportation expenses

In the Geneva canton, in 2024, travel expenses are strictly limited to CHF 529 per year. Whether you use the new electric bike you bought to accommodate your physical or ecological awareness, your car to commute from Hermance to Versoix every day, or public transportation: the maximum deduction authorized by the canton and your municipality will be CHF 529, not a single cent more. On the other hand, if your employer contributes to your transportation costs, you will not be able to benefit from this deduction (this is the case if a cross appears in the “F” box of your salary certificate).

Please note that this threshold, like many others, differs when it comes to the direct federal tax (IFD) which limits this deduction to CHF 3’200 per year and can vary depending on the means of transport you use.

- Business expenses: meal expenses

Here again, the conditions are relatively strict compared with other cantons: the deduction of meal expenses will only be accepted if the TPG does not allow you to make the ‘work-home’ journey in less than 30 minutes. Long story short: if you live within 30 minutes (one way) from your workplace, forget about the meal expenses deduction.

Otherwise, you will be able to deduct CHF 15.00 per day up to a maximum of CHF 3’200 per year for meal expenses incurred outside of your home, provided that your employer does not contribute to it. If in doubt regarding your employer’s contribution, you can always refer to your salary certificate: a check marked in box “G” on your salary certificate will halve the allowed deduction to CHF 7.5 per day, for a maximum of CHF 1’600 per year.

Flat rate business expenses

The canton of Geneva offers an alternative for those who live close to their place of work: the deduction of a lump sum for professional meals and transportation expenses. This amount will range from CHF 634 to CHF 1796 for all salaried individuals, and will depend on the gross salary, reduced by the AVS / AI / APG / Unemployment / AANP / Amat contributions and those of the 2nd pillar – all of which are detailed on the salary certificate.

Grab your calculator!

- Take your total gross salary – box 8

- Deduct the sum of the above-mentioned social contributions (boxes 9 and 10.1)

- Multiply it by 3%.

What do you get? Remember, the minimum is CHF 634, which means that even if the result is lower, tax authorities will admit a CHF 634 deduction. The same goes for the maximum, so if it is greater than CHF 1796, you will only be entitled to the maximum lump sum deduction of CHF 1796. Between these two thresholds, the amount obtained will be deductible as is.

Obviously, you can either claim a lump-sum deduction or deduct the actual expenses, if properly documented. Remember to check which of these options is the most suitable for you and… If you have any questions, just contact us!

Business expenses: Other Actual Expenses

On top of transportation and meals, other expenses are incurred by some employees in order to carry out their professional activity. If you kept records, you could expect to deduct, for example, your union dues as specified in the tax guide, or work clothes and other items required for work, as long as your employer does not provide them to you. Keep in mind, the key parameter here is “required to work”, and as a simple example, vet expenses are not in scope.

Deduction #2: Health and accident insurance premiums

The reality is that basic health insurance premiums (also called LAMal /AOS premiums) are particularly high and often represent a significant expense for Geneva households. Adding accident and supplementary health insurances premiums might be even scariest. Although it will certainly not balance everything out, you should not forget about the substantial tax deduction resulting from these costs.

Indeed, you will be able to deduct from your income up to twice the amount of the average cantonal premium, per age group. The maximum annual deductible amounts are the following for fiscal year 2024:

- Children: CHF 3’811

- From 18 to 26 years old: CHF 12’442

- Adutls: CHF 16’207

Let’s illustrate with an example, or even two:

Maé, who has just turned 28, lives alone in Hermance with her 4-year-old son Joé. She does not receive any subsidy.

- Her basic and supplementary health insurances cost her CHF 540 per month, i.e. CHF 6’480 per year – a significant amount but typical given the coverage she benefits from. For Joé, the premiums reach CHF 154 per month, or CHF 1’848 per year. In total, she spends CHF 8,328 per year on health insurance for her family.

Facing GeTax, she wonders how much she can claim. Let’s have a look at it together:

The maximum authorized deduction in her situation would be CHF 20’018 (3’811 for Joé + 16’207 for Maé). Thus, she will be able to deduct the entirety of her health insurance premiums, i.e. CHF 8’328.

- Now let’s imagine that Maé did not take the time to get familiar with the usual health insurance premiums, or that she was poorly advised. For the same coverage, she spends CHF 1’400 per month, and still CHF 154 for Joé. Annually, her expenses amount to CHF 18’648 (CHF 18’000 for her + CHF 1’848 for Joé). What can she claim for deduction?

All of Joé’s premiums can be deducted, as they remain below CHF 3’811. On the other hand, hers exceed CHF 16’207. Bottom line?

She would be granted a CHF 18’055 total deduction (CHF 1’848 for Joé, and CHF 16’207 for herself). The additional CHF 593 exceeding the threshold cannot be claimed.

The second point example may seem extreme, but we are regularly surprised by the premiums our clients pay. It may be worth checking, or have someone checking, the coverage/premium ratio from time to time.

Deduction #3: Medical expenses

Let’s stick to health matters for a moment, but now focusing on medical expenses. These too can be deducted if they are invoiced at your expense and not covered by your health insurance provider nor any other organization.

In this case, you will be allowed to deduct the actual amount that exceeds 0.5% of your net income after a couple of additional deductions. Proceeding step by step:

- Take your net salary (gross salary minus first and second pillar contributions as shown on your salary certificate)

- Deduct from this amount, if applicable:

- Your pillar 3A, pillar 3B and LPP contributions (you will find more details on this topic in points 4 and 5)

- Your professional expenses, actual or lump sum,

- Your health and accident insurance premiums, as defined in point 2

- Your childcare expenses

- Finally, multiply the amount obtained, after deductions, by 0.005: this is the minimum deduction. In other words, if your medical expenses are lower than this figure, you cannot deduct them. However, anything exceeding this value is deductible from your ICC income.

- In a nutshell, the maximum deduction allowed is your actual medical expenses reduced by the amount in iii.

Deduction #4: The pillar 3A

Next, let’s focus on what is considered to be the most elementary tax optimization, the pillar 3A. There is a wide range of products available and promoted on the market, of which you have surely heard about. Before we deal with the deductions related to this voluntary contribution, let’s quickly check: you still think that the “A” stands for “Assurance” – Insurance, in French? If so, let’s pause here and get back to basics. We recommend that you first visit this page, which will remind you of the fundamentals of the 3rd pillar A. Once comfortable with key notions, the question of the contributions naturally arises, and here again grab your hand to deep dive.

The major strength of the pillar 3A is that it is deductible. Indeed, whether it is concluded with a bank or an insurance company, it combines a number of advantages, all of which are easily and instantly measurable. Let’s start with the mechanism:

- You can freely choose the amount you wish to contribute annually, and, as an employee, it can be deducted from your taxable income as long as the amount doesn’t exceed CHF 7’056 per year (Incidentally, this amount is the maximum in 2024, which was adjusted upwards in 2023). First good point. For self-employed persons, the maximum deduction is CHF 35’280, or 20% of the annual income.

- From a wealth taxation perspective, it’s pretty simple. The capital saved over the years is not taxable and thus “disappears” from the tax authorities’ radar until you decide to withdraw your 3rd pillar.

As promised, let’s quantify this with an example focused on cantonal and communal taxes (ICC):

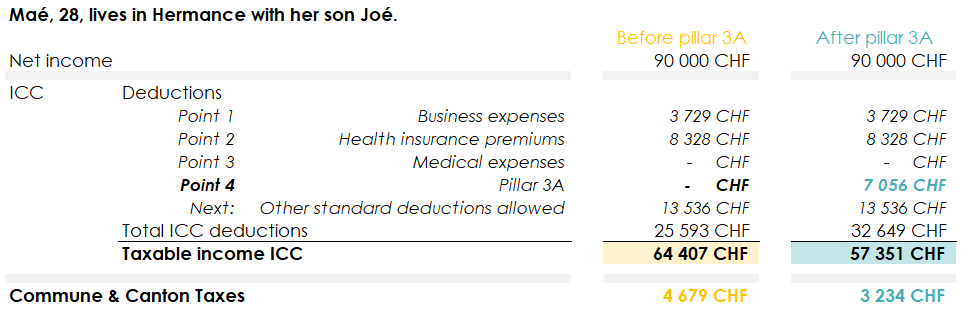

For her 2024 tax return, Maé bites on the bullet. Early November 2024, she takes a moment to consider her fiscal situation, looking for a simple way to minimize her tax burden. As she recently got promoted and benefited from a salary increase, she quickly realizes that she saves a few hundred extra francs each month.

Assuming she does not contribute to a pillar 3A, her taxable income post deductions would approximate CHF 64’400 and she would have to pay CHF 4’680 of ICC income tax. Like most people, she heard about the possibility of allocating some savings to a third pillar A, from which she will benefit on the day she retires. At least for this year, she selected a bank product. Before proceeding with the transfer, she asks that we precisely evaluate the impact of her decision.

By allocating CHF 7’056 to her 3A, she reduces her taxable income to CHF 57’350. As a result, his tax bill is also lower and his final ICC bill is CHF 3’235, or CHF 1’445 less than if she had kept her savings under her pillow. Looked at another way, that still represents a return on investment of 20.5%! Pretty attractive, don’t you think? Not to mention that the deduction also applies at federal level (even better).

We’d like to take this opportunity to illustrate the extent to which your personal situation can have an impact on your tax burden. Just for a moment, let’s imagine Maé as a single person without children (sorry, Joé), with the same taxable income, i.e. CHF 64,400 before 3A, and CHF 57,350 after.

Without children or 3A, her tax burden would be CHF 10,250; with 3A, it would be limited to CHF 8,430, saving CHF 1,820 in tax. Conclusions?

- The tax saving you can make with a 3A (or any other additional deduction) depends mainly on your marginal tax rate: the higher your marginal tax rate, the greater the saving.

- Beware of advisers who claim to be able to save you the same amount of tax as your neighbour, with the same product, without having any knowledge of your tax situation. Every situation, including your own, is unique, and yet it’s not uncommon to be approached by ‘soothsayer advisers’.

Deduction #5: The Pillar 3 B

Because it is deductible in the canton of Geneva specifically, the pillar 3B has a potential too. The maximum amount depends on your employment status as well as your household’s composition. For employees, figures listed below can be added up to know the total deduction that could be granted in 2024:

- Single person: CHF 2’324

- For a married couple or a couple in a registered partnership: CHF 3’486

- Per dependent child: CHF 951

Should only one member of the household work, or should it be composed of self-employed people, above thresholds are adjusted upwards, allowing greater deductions.

Deduction #6: LPP years buyback

Another aspect of retirement planning in Switzerland involves deducting the capital allocated to your second pillar. Here, we are not referring to the usual contributions that you and your employer contractually make to your 2nd pillar, but rather to an individual and optional choice to bridge a gap, created over time.

Each franc invested today for your later years is, without upper limit, deductible from your taxable income and will allow you to reduce your tax burden for the current year. But beware, although attractive, some fundamental notions must be understood before proceeding with this type of mechanism. First of all, make sure you understand your LPP certificate in order to identify the magnitude of potential buybacks, and the optimal timing. If necessary, our comprehensive guide to 2nd pillar buybacks is available for consultation.

Few doubts remain as to how the Swiss pension system works and you are not yet comfortable with the terminology of the second pillar? These definitions should clarify it all.

Deduction #7: Third-party childcare expenses

No grandparents around and a busy job? In case you need to hire a third party to take care of your child/children under 14 years old in order to carry out your work duties or to attend your training, you can deduct these expenses up to a maximum of CHF 26’080 per child and per year, at least in 2024. For married couples, or couples in a registered partnership, this will only be accepted if both of you are in employment – or are permanently unable to work.

Deduction #8: Alimony payment

Life is not always a smooth ride, and we all know it happens that pathways diverge. Fine, no need to further elaborate. If you pay your ex-partner alimony or maintenance (for him/herself or your children), here is a small consolation: you can deduct the entire amount.

Deduction #9: Family allowance

In the canton of Geneva, as you may have noticed, the same tax scale applies to all those who are taxed “ordinarily”. The family allowance is a social deduction established to rebalance this scale and allow people with children to reduce their taxable income (ah, finally getting serious). Sounds good, but then how much are we talking about?

This will depend on the number of fiscal charges and half charges attributed to your household:

- In 2024, for people who have not claimed deductions for childcare costs (you can already sense the downside), the lump sum is CHF 13’536 per charge, and CHF 6’768 per half charge (note that these latest values are for 2023, and will be updated once the new ones are published).

- If you entrust from time to time the care of your children to third parties and have claimed in point 7. the deduction of the expenses incurred, then the limit will be set at CHF 10’000 per charge, and CHF 5’000 per half charge.

A brief digression: what is considered as a fiscal charge?

First and foremost, a dependent child who is being financially supported. Whether the child is a minor or a young adult (student or apprentice under 25 years old) the decisive factor will be his income. In 2023, as long as it was below CHF 15’557, you will be allocated a charge for each child meeting this condition. The term “half-charge ” is applicable when his income is between CHF 15’557 and CHF 23’335 and the assets of the young adult do not exceed CHF 88’766.

This applies to children, but also to other “dependents”.

Deduction #10: The deduction granted on one spouse’s earnings

This special deduction is granted to couples (married or in registered partnership) when both are working. The good news is that the one with the lowest income will be able to deduct CHF 1’041 from his/her taxable income, as long as conducted activity is not related to the one of the spouse with the higher income!

If you have reached this point, I trust you can now accurately simulate your 2022 taxable income and perform your 2024 tax return early 2025. Nevertheless, as practical as this guide is, it does not take all deductions into consideration. But at least we hope it brought clarity to the most important ones.